Renters Insurance in and around Suffolk

Welcome, home & apartment renters of Suffolk!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Franklin

- Windsor

- Zuni

- Ivor

- Wakefield

- Smithfield

- Newport News

- Hampton

- Williamsburg

- Yorktown

- Portsmouth

- Norfolk

- Chesapeake

- Virginia Beach

- Elizabeth City, NC

- Moyock, NC

- Gates, NC

- Ahoskie, NC

- Corapeake, NC

- Currituck, NC

- Winton, NC

Home Sweet Home Starts With State Farm

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your smartphone to your silverware. Unsure how to choose a level of coverage? That's okay! Ken DeLoach is ready to help you evaluate your risks and help pick the appropriate policy today.

Welcome, home & apartment renters of Suffolk!

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Ken DeLoach can help you identify the right coverage for when the unanticipated, like a water leak or a fire, affects your personal belongings.

There's no better time than the present! Get in touch with Ken DeLoach's office today to learn more about State Farm's coverage and savings options.

Have More Questions About Renters Insurance?

Call Ken at (757) 934-1329 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

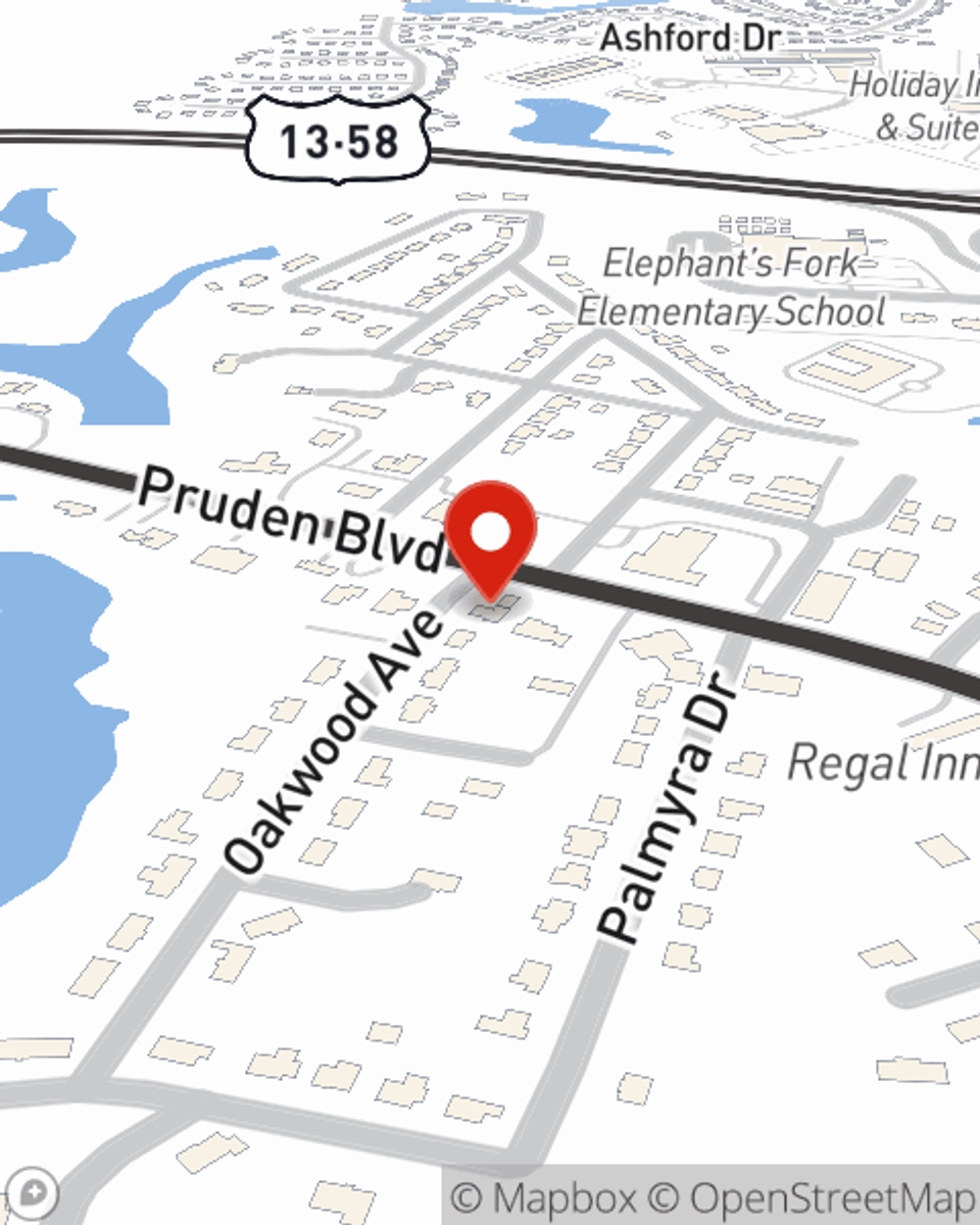

Ken DeLoach

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.